A letter of credit is a guarantee of the buyer

to the seller about the payment that has to be made. The basic structure of the

Letter of Credit consists of four elements: Applicant (the buyer or the

importer of goods), Beneficiary (the seller or the exporter), Issuing Bank

(lends its guarantee or credit to the transaction), and the Negotiating Bank

(beneficiary's bank).

The letter of credit assumes that certain

conditions would be met by the client or the buyer for the payment in question.

This thing may be arranged by the customer (buyer, client) for the bill amount

to the seller (beneficiary; in this case, the transport company) for the

services rendered. The payment is expected to be made on time. In cases there

is a delay, the bank makes the payment of the balance amount on behalf of the

buyer. Banks collect some percentage of the amount in the transaction as a fee.

This fee depends on the amount requested for the deal in the letter of credit.

This is significant to note here that the sales agreement between a buyer and

seller is not a part of the credit letter. The letter of credit may only use

the information in the contract.

What does the LOC contain? It contains

information about the agreement between the buyer (client) and the seller (Movers and

packers). The deal includes charges for the move, the quantity of the

goods to be transported and other matters regarding the time and distance for

the shift.

What is the necessity for LOC? The LOC gives

confidence to the seller that he will receive the payment agreed upon by the

buyer/client.

How does one get the letter of credit (LOC)? It

can be obtained on request from the bank where the buyer has his or her

account. The details about the amount, name, and address of the beneficiary,

shipping date, mode of shipping, etc. have to be furnished by the applicant or

the buyer. When the bank receives the necessary details, it will be responsible

for sending the money.

What is the significance of the letter of credit

(LOC)? The LOC forms a gauge by which payments can be made when a deal is

struck between a mover and a client. This LOC will help both the parties to

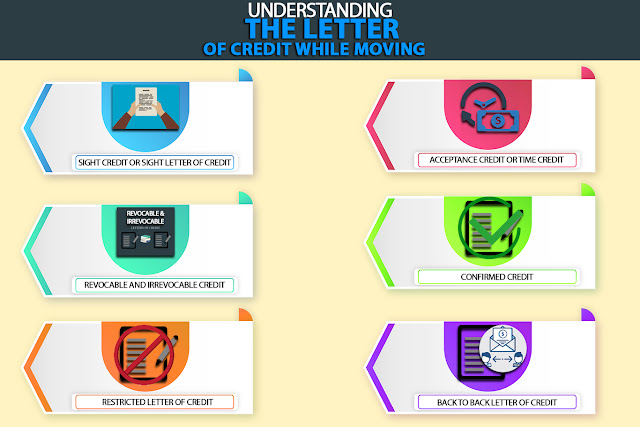

avoid engaging in endless bargaining. Here are some types of Letter of Credit.

1. Sight Credit or Sight Letter of Credit

This thing is a transaction that is done

immediately upon presentation of valid documents. The needed funds can be taken

right away. This document specifies the payments that need to be made for goods

and services. For example, if a particular company of packers and movers Bangalore have offered to

move your goods from Delhi to Mumbai, the LOC will give the details of how much

is to be paid and when it is to be done. It is a kind of agreement.

2. Acceptance Credit or Time Credit

In this case, the bills have to be presented and

honored on their respective due dates. For example, in some cases, the purchase

and the payment may take place on the same day. In other cases, the payment may

be made after some time. This last period is called the usance for sale. The

buyer makes the payment on the stipulated date of the LC.

3. Revocable and Irrevocable Credit

Revocable credit is where the terms and

conditions can be changed or even canceled without giving any prior notice to

or getting the consent of the beneficiary. The cancellation can be made without

any notice. A permanent credit is just the opposite where the terms and

conditions cannot be changed or amended. Letters of Credit usually are

irrevocable.

4. Confirmed Credit

This type of credit is that one where a

different bank confirms the loan, i.e., a bank other than the issuing bank. In

this kind of deal, the beneficiary will have a firm undertaking from both the

issuing as well as the confirming bank. The bank that partners as a confirming

bank, become a part of the contract of the letter of credit.

5. Restricted Letter of Credit

In this case, a specific bank takes on the task

to accept, pay, and negotiate the LC.