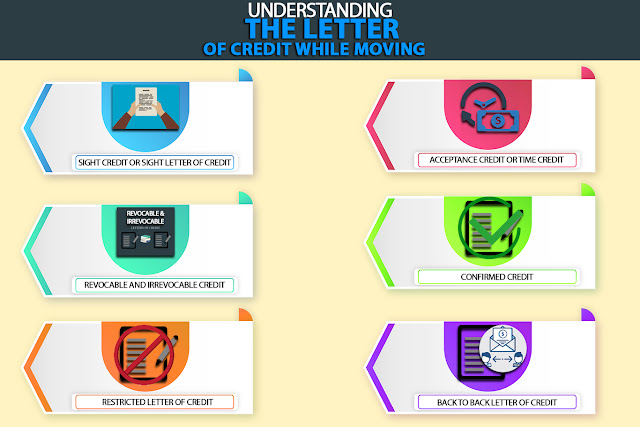

Understanding the Letter of Credit while moving

A letter of credit is a guarantee of the buyer to the seller about the payment that has to be made. The basic structure of the Letter of Credit consists of four elements: Applicant (the buyer or the importer of goods), Beneficiary (the seller or the exporter), Issuing Bank (lends its guarantee or credit to the transaction), and the Negotiating Bank (beneficiary's bank). The letter of credit assumes that certain conditions would be met by the client or the buyer for the payment in question. This thing may be arranged by the customer (buyer, client) for the bill amount to the seller (beneficiary; in this case, the transport company) for the services rendered. The payment is expected to be made on time. In cases there is a delay, the bank makes the payment of the balance amount on behalf of the buyer. Banks collect some percentage of the amount in the transaction as a fee. This fee depends on the amount requested for the deal in the letter of credit. This is significant to not...